Getting My Feie Calculator To Work

9 Easy Facts About Feie Calculator Shown

Table of ContentsSome Known Factual Statements About Feie Calculator A Biased View of Feie CalculatorUnknown Facts About Feie CalculatorUnknown Facts About Feie CalculatorGet This Report on Feie CalculatorAll about Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.

If he 'd frequently traveled, he would instead finish Component III, listing the 12-month duration he fulfilled the Physical Presence Examination and his traveling background - Taxes for American Expats. Step 3: Reporting Foreign Income (Part IV): Mark earned 4,500 each month (54,000 annually). He enters this under "Foreign Earned Revenue." If his employer-provided housing, its value is likewise included.Mark determines the exchange price (e.g., 1 EUR = 1.10 USD) and transforms his wage (54,000 1.10 = $59,400). Because he lived in Germany all year, the percentage of time he stayed abroad throughout the tax is 100% and he gets in $59,400 as his FEIE. Mark reports total wages on his Type 1040 and enters the FEIE as an adverse quantity on Arrange 1, Line 8d, reducing his taxed earnings.

Picking the FEIE when it's not the very best option: The FEIE may not be suitable if you have a high unearned earnings, make more than the exemption restriction, or live in a high-tax nation where the Foreign Tax Obligation Credit Rating (FTC) may be a lot more advantageous. The Foreign Tax Obligation Credit Score (FTC) is a tax decrease approach often used in conjunction with the FEIE.

Little Known Facts About Feie Calculator.

expats to counter their united state tax financial obligation with foreign revenue taxes paid on a dollar-for-dollar reduction basis. This implies that in high-tax countries, the FTC can usually get rid of U.S. tax obligation financial debt completely. Nevertheless, the FTC has restrictions on qualified tax obligations and the maximum claim amount: Qualified tax obligations: Only income tax obligations (or tax obligations in lieu of earnings taxes) paid to foreign federal governments are eligible.

tax obligation responsibility on your international revenue. If the foreign tax obligations you paid surpass this limitation, the excess international tax obligation can normally be brought onward for as much as ten years or lugged back one year (using a modified return). Maintaining accurate records of foreign revenue and tax obligations paid is for that reason crucial to calculating the correct FTC and preserving tax compliance.

expatriates to decrease their tax obligation responsibilities. For instance, if a united state taxpayer has $250,000 in foreign-earned revenue, they can leave out approximately $130,000 utilizing the FEIE (2025 ). The staying $120,000 may then be subject to taxation, but the U.S. taxpayer can potentially apply the Foreign Tax Debt to counter the tax obligations paid to the international nation.

Little Known Facts About Feie Calculator.

He offered his U.S. home to develop his intent to live abroad permanently and used for a Mexican residency visa with his better half to aid accomplish the Bona Fide Residency Test. Additionally, Neil secured a long-lasting property lease in Mexico, with strategies to eventually buy a building. "I currently have a six-month lease on a residence in Mexico that I can extend one more 6 months, with the objective to purchase a home down there." However, Neil aims out that purchasing home abroad can be testing without initial experiencing the area.

"It's something that individuals require to be truly attentive regarding," he says, and advises deportees to be mindful of typical blunders, such as overstaying in the U.S.

Neil is careful to cautious to Stress and anxiety tax authorities tax obligation "I'm not conducting any business any kind of Service. The U.S. is one of the few countries that tax obligations its people no matter of where they live, meaning that also if an expat has no income from United state

What Does Feie Calculator Do?

tax return. "The Foreign Tax Credit report enables people working in high-tax nations like the UK to offset their United state tax obligation responsibility by the amount they've already paid in tax obligations abroad," says Lewis.

The prospect of lower living expenses can be tempting, yet it often comes with trade-offs that aren't right away apparent - https://www.pubpub.org/user/feie-calculator. Housing, for instance, can be extra inexpensive in some countries, but this can mean compromising on infrastructure, safety, or access to trusted energies and services. Inexpensive buildings may be situated in locations with irregular internet, restricted public transportation, or unstable health care facilitiesfactors that can substantially affect your day-to-day life

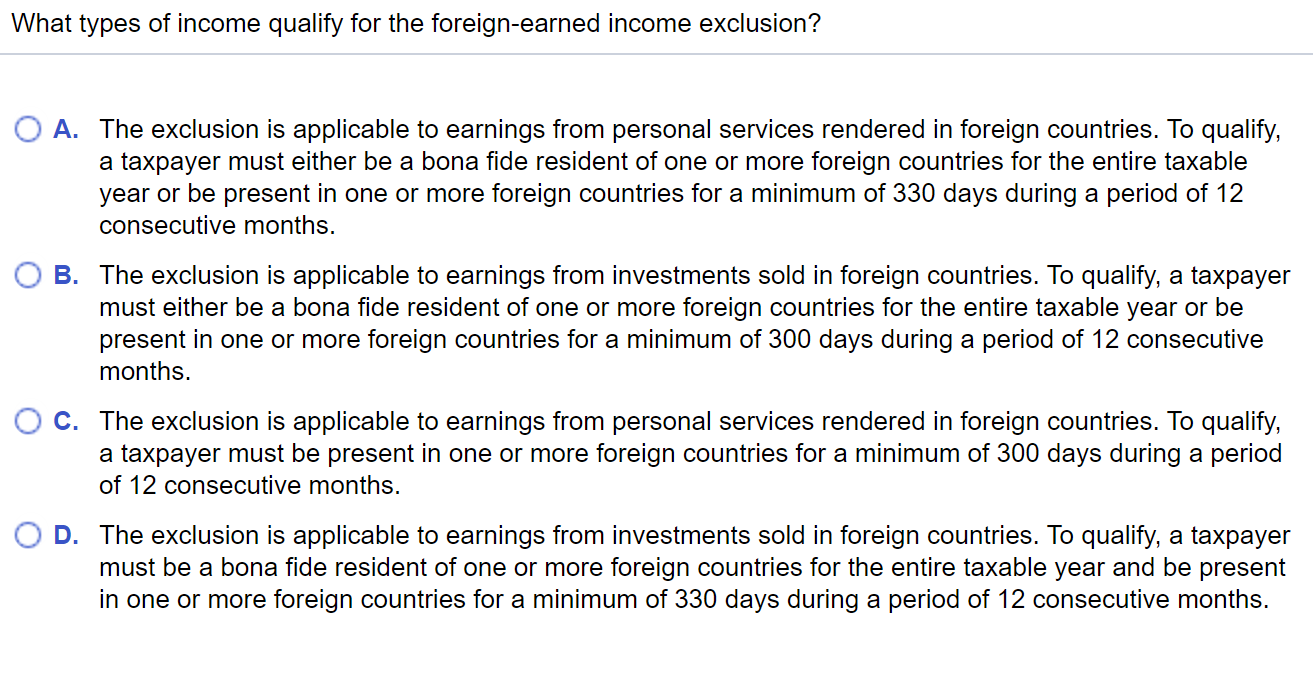

Below are several of the most frequently asked inquiries regarding the FEIE and other exemptions The Foreign Earned Income Exemption (FEIE) permits U.S. taxpayers to exclude up to $130,000 of foreign-earned income from federal revenue tax, minimizing their U.S. tax obligation. To get approved for FEIE, you need to fulfill either the Physical Existence Examination (330 days abroad) or the Authentic House Examination (prove your key home in an international country for an entire tax obligation year).

The Physical Presence Examination needs you to be outside the U.S. for 330 days within a 12-month duration. The Physical Visibility Test likewise requires united state taxpayers to have both a foreign income and a foreign tax home. A tax obligation home is specified as your prime area for service or work, regardless of your family's residence. https://site-mtfua8qr1.godaddysites.com/.

Indicators on Feie Calculator You Need To Know

An income tax treaty between the united state and another nation can assist prevent dual taxation. While the Foreign Earned Earnings Exemption minimizes gross income, a treaty might give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for declare united state residents with over $10,000 in foreign financial accounts.

The international earned income exemptions, occasionally referred to as the Sec. 911 exclusions, leave out tax on salaries gained from functioning abroad. The exclusions consist of 2 components - an income exemption and a housing exemption. The adhering to FAQs go over the benefit of the exemptions including when both spouses are deportees in a general manner.

What Does Feie Calculator Do?

The revenue exclusion is currently indexed for inflation. The optimal yearly revenue exclusion is $130,000 for 2025. The tax obligation advantage omits the earnings from tax obligation at bottom tax prices. Previously, the exclusions "came off the top" lowering revenue based on tax on top tax obligation prices. The exemptions might or might not reduce income utilized for various other objectives, such as individual retirement that site account limits, kid credit reports, individual exemptions, etc.

These exemptions do not excuse the salaries from United States taxes but merely provide a tax decrease. Note that a bachelor working abroad for all of 2025 that gained regarding $145,000 without various other earnings will have taxable income reduced to absolutely no - effectively the very same solution as being "tax cost-free." The exclusions are calculated each day.

If you attended company conferences or workshops in the US while living abroad, income for those days can not be left out. Your earnings can be paid in the US or abroad. Your company's place or the location where salaries are paid are not consider getting the exclusions. Physical Presence Test for FEIE. No. For US tax obligation it does not matter where you keep your funds - you are taxed on your around the world revenue as a United States individual.